So after 30+ months of searching for a home, during which time we had been invited to no fewer than 3 of the annual garden parties they host, had been transported by volumes of photos and had come to know more than we’d imagined possible about where the slide zones stop and the faults pass, we came to closing. It is at this point that Carol, with her quiet, methodical, and error-free diligence marshals, organises, and processes the reams of paper that are the essence of closing. She was brilliant.

There are lots of realtors around but if integrity, expertise, and wise counsel are priorities, Ira and Carol are the ones. When you’re done, you’ll have either bought or sold a house, learned a few things, enjoyed the experience, and made some good friends.

Yusuf & Leila Giansiracusa

Closing – Making The Home Yours!

We’re on the home stretch! Here’s what to consider as closing approaches:

IMPORTANT

Wait before …

- Changing your job

- Making large purchases

- Applying for credit cards or loans

Lenders do a last-minute credit check and employment confirmations. Changing jobs or major purchases such as a new car can cause the lender to revoke loan approval. Wait until after closing for your new job or car.

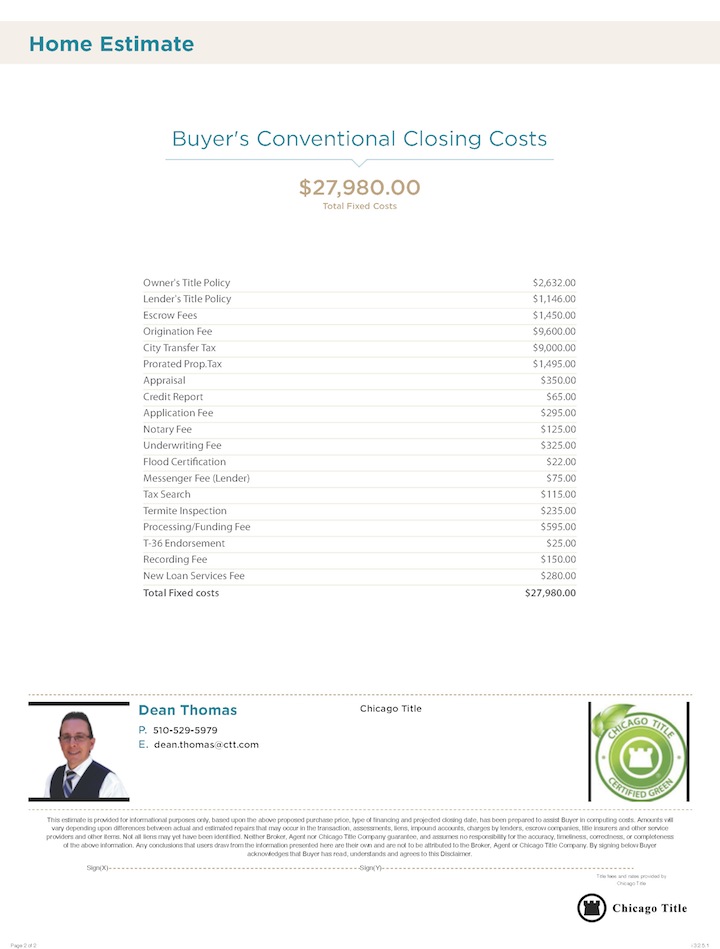

We Send The Title Company Escrow Instructions

We send escrow instructions to the title company – the purchase price, deposits, property tax pro-rations, insurance information, and more. They prepare an estimated closing statement, which we’ll review with you to make sure it accurately reflects the terms of the purchase agreement.

Timing – Vacation or Travel

Let us know if you have any vacations or travel plans. Ask the title company to prepare a power-of-attorney form if you want to give that ability to a co-buyer or trusted friend.

The title company can schedule a notary to meet you at your home or office. If you’re signing in a different state, they’ll need to attach the appropriate notary tag to the appropriate.

If you’re overseas, your documents have to be signed at a US Consulate; be sure to check their schedule and hours and to make sure the paperwork’s returned in time. NOTE: This greatly complicates signing and can delay closing!

Decide How You Want To Take Title

Your attorney will advise you of your different options; just let the title company know. When you speak to your attorney, be sure to have them advise you about the pros and cons of setting up a living trust.

Schedule Your Appointment

Bring a driver’s license, Real ID, or passport. The title company will need this proof at the time they notarize documents. NOTE: The notary will ask for a thumbprint when they notarize the documents.

Wire The Balance Of Your Down Payment And Closing Costs

WARNING! Spammers have been known to monitor unsecured emails and send fake wiring instructions. Assume that anyone sending wiring instructions by email or phone is coming from someone with nefarious objectives. Be particularly wary of any changes in wiring instructions. We will NEVER send you wiring instructions.

Insurance

Make sure you’ll have insurance in place by closing – this is particularly important on all-cash sales. Confirm that you have replacement value, an appropriate liability policy, earthquake insurance if you want it, and an Owner/Landlord/Tenant Policy if the seller is remaining in possession after the close.

Selling? Wait until after the closing to cancel your policy.

Meet Us For The Walk-Through Inspection

We’ll schedule a final walk-through of the home prior to closing. This is to make sure the home’s in essentially the same condition as when you made your offer, contractual repairs have been made, and appliances which are to be included … are included!

What’s Closing Like?

In some states, everyone sits around a table, the buyer gives the seller the funds, the seller gives the buyer the deed and keys and there’s a celebration all around.

It’s different in California.

You won’t be there at the closing!

You and the sellers sign closing papers at different times. Once the title company has the document they need from everyone, and the funds for your down payment and loan, they release the deed and lenders deeds of trust to be recorded at the county. The title company usually contacts us by early afternoon to let us know that they’ve received confirmation of closing.

That’s when we call you and say CONGRATULATIONS!

Put the utilities in your name

Schedule this to happen a few days before the closing.

Rekey The Locks

Once you’ve closed, we give you the keys. Have a locksmith rekey the locks so you are the only people who have access. It’s much less expensive to have the locksmith change the cylinder and rekey the lock than change out the hardware.

Expect a surprise from the County Assessor … just when you’re about to forget we’ve talked about this.

The current property taxes are pro-rated at closing, and then, many months after closing, you’ll receive a Supplemental Tax Bill from the County! Let’s say the previous owner has an assessed value of $500,000 … and you paid $1,750,000 for your home. Your supplemental bill will be based upon the $1,250,000 difference in assessed value. You’ll be billed for a portion of the tax year, which runs from 1 Jul to 30 Jun. Thus, if you close on 1 Apr, you’ll be billed for 3 months (or 3/12 of taxes for a $1,250,000 assessment).

Send out Change of Address Card … and Register to Vote

Here’s where to register to vote.

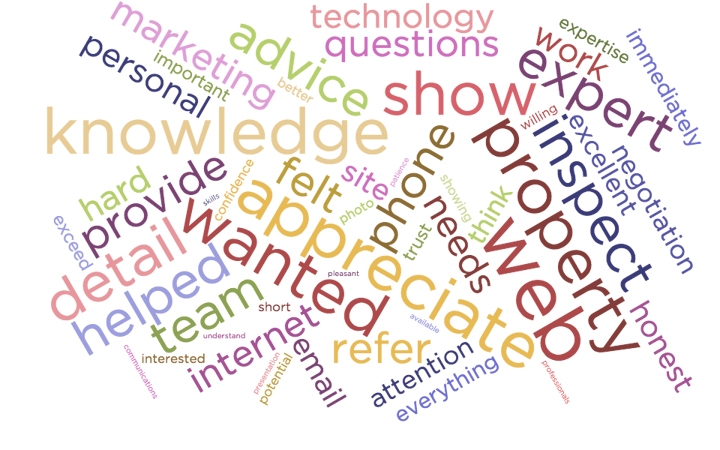

And Refer Us To Your Friends And Tell Others What You Loved About Having Us Represent You

#RealEstate #Buyer #BuyerBroker #Escrow #Closing #Serkes