When we relocated to the Bay Area, we contacted Ira and Carol Serkes to help us find a home. Ira and Carol spent a great deal of time with us to determine what was important to us – the type of house, the neighborhood and other amenities. Together, we found the perfect home. Ira and Carol worked with us to structure the offer, offering recommendations and valuable insights on the Berkeley real estate market. They were there during the inspections and provided excellent recommendations for inspectors as well as contractors so that we could obtain quotes for items noted during inspection.

Theodore & Deborah Kallman

Our “home work” is designed to make home-buying as smooth as possible for you. This page gives you a quick overview of things to consider

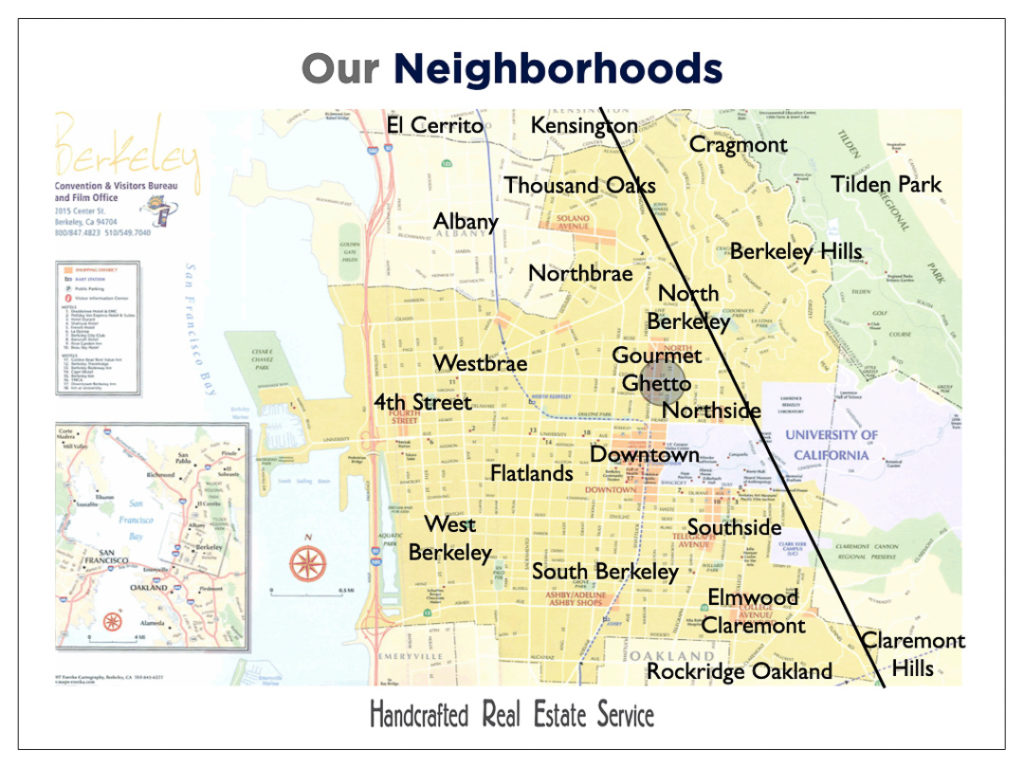

Identify Your Ideal Neighborhood

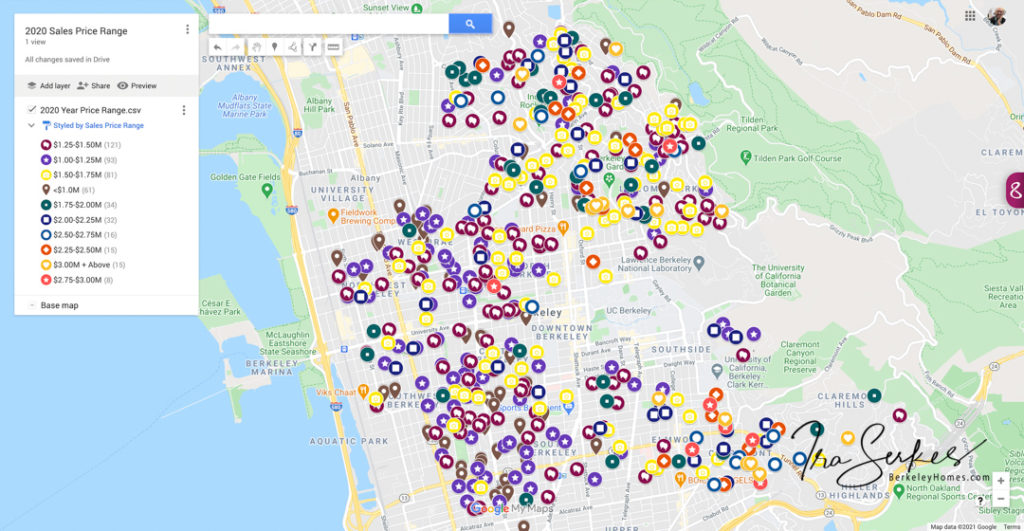

Let us know what’s important to you and we’ll show you the best neighborhoods to look in, then create a custom map based on your price, bedroom, size, and neighborhoods showing you all the homes you could have recently purchased that met all those criteria!

The shows 2020 sales price ranges within each neighborhood

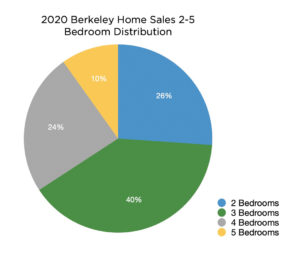

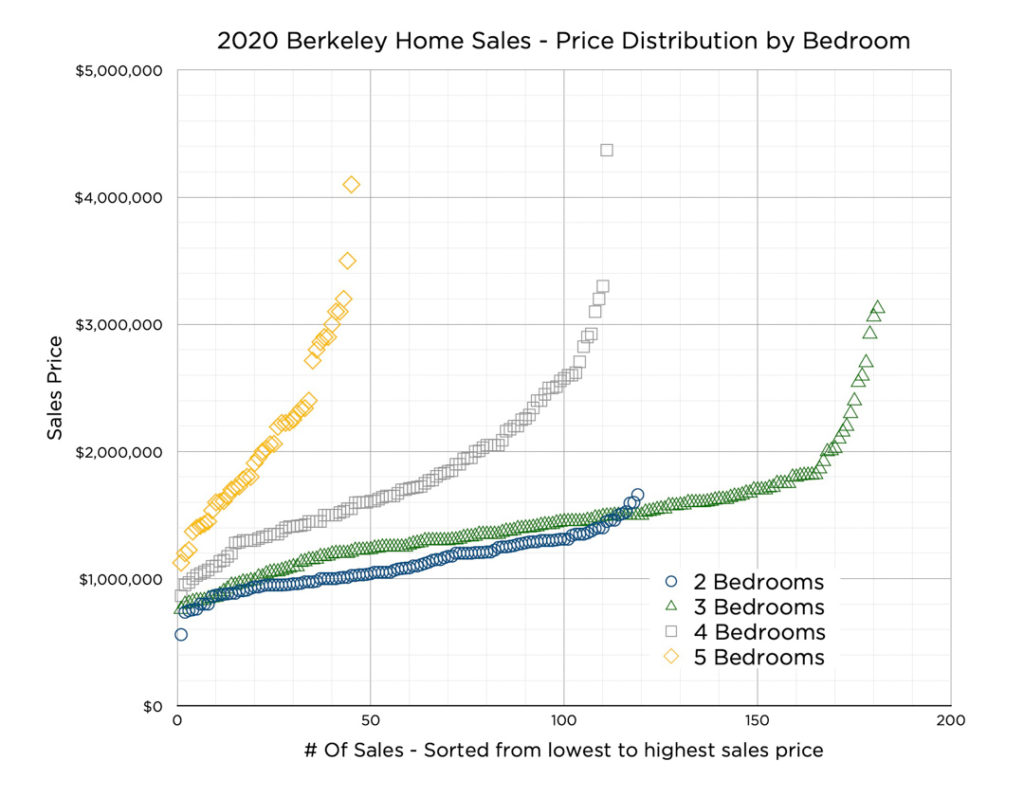

Distribution of Berkeley Sales Prices … By Bedroom – Prices are sorted from the lowest to the highest

2020 Median Prices

Identify Your Ideal Home

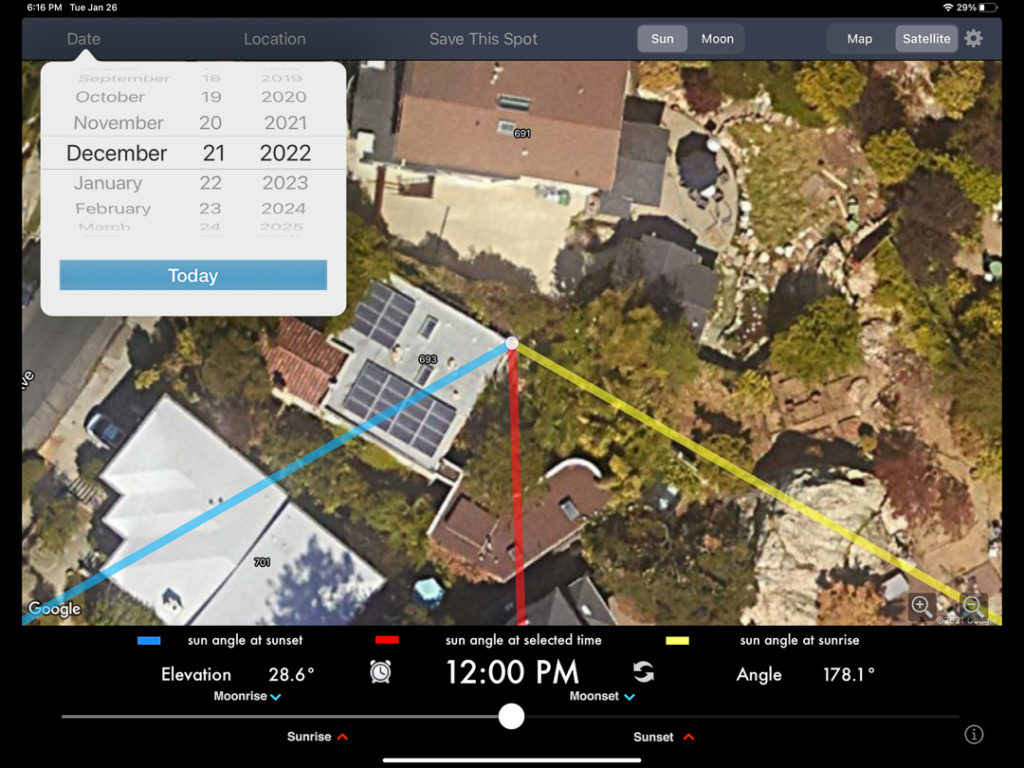

Important factors are price range, bedrooms, neighborhood, and condition. Want a sunny home or yard? I have an app for that! When the yard gets sun on the shortest day of the year, it gets sun the rest of the year. That’s our roof – we’ve since added 4 more panels so now have a 28-panel photovoltaic system.

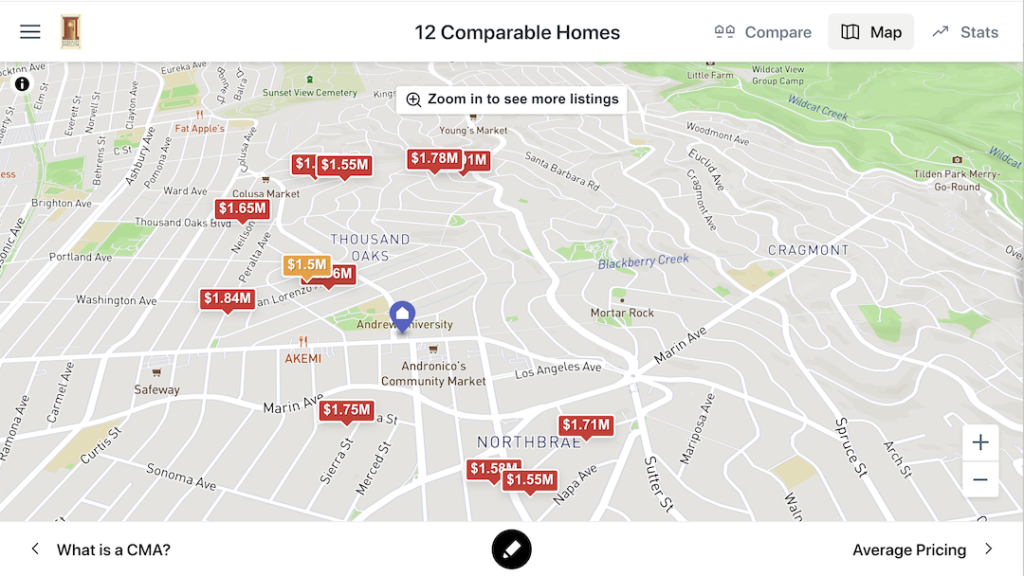

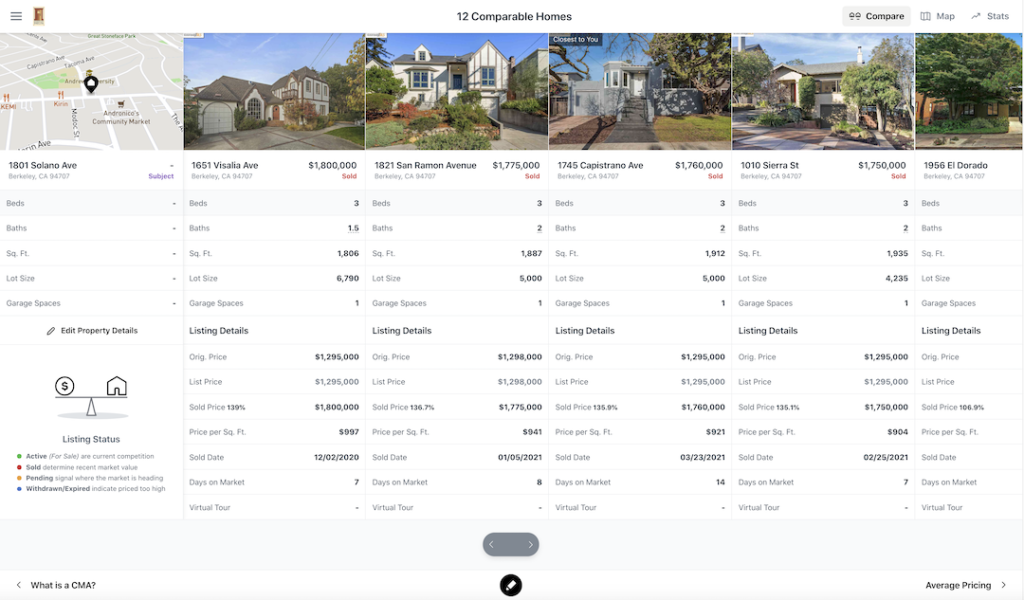

First Step – Showing You The Homes Which Met Your Criteria

We’ll show you which homes sold in the past 6 months which have met those specs, map them, and prepare a detailed photo and market analysis report for you.

This step shows you the homes you could have purchased, lets us review what you like or dislike about them, and helps us focus more finely upon your ideal home.

You’ll usually be able to select from 2 or 3 homes each month. If there are only 1 or 2 homes each month, we can explore how adjusting your criteria increases the selection.

Click the map or photos to view a sample report.

Each of these homes met your criteria!

Find Out What Will Your Commute Be Like

Ask your co-workers about different commute options. It could be BART or casual car pool; AC Transit or Company Bus, Highway or Amtrak, or a combination of them – carpool to work, BART back home.

This google map makes it easy. We programmed it to give give you directions to our COMPASS office in North Berkeley. Change the destinations to be your job and one of your preferred neighborhoods, and “the google” will calculate commute times for you.

Click the map for AC Transit trip planner and schedules – lettered lines to directly to San Francisco

BART Stations and AC Transit Lines – Lettered Lines Go To San Francisco

Determine Your Target Price Range And Get Approved By A Lender

We’ll want to move quickly when the ideal home comes on the market; the first step is to get loan pre-approval out of the way.

We’ll refer you to excellent lenders. Be sure to tell them if you’re borrowing money from family or relocating from overseas … it can affect the pre-approval process and your closing date.

We know that sellers’ agents feel much more comfortable when we give them a loan pre-approval from a local lender rather than an online lender. In one case, the seller rejected our buyers’ offer because they were using an online lender. You may get a loan from any lender you wish; we simply recommend that you also have a pre-approval letter from a local lender.

Most buyers search below their maximum price. Let us know your upper price range so we can be on the lookout for a great home that might be at a different price point.

Ask Your Lender For An Estimate Of Closing Costs

Ask your lender to provide an estimate of the closing costs. They can total 2-3% of the purchase price, and include:

- One-time fees – escrow, title, loan charges, and transfer taxes

- Annual expenses – property taxes, property insurance

- Pro-rated expenses – prepaid loan interest, this year’s property tax bill

The City Transfer Taxes is typically split 50:50 between buyer and seller. The Berkeley Transfer Tax is 1.50% of the purchase price. or $18,000 for a $1,200,000 home. It currently increases to 2.5% for homes selling for more than $1,500.000.

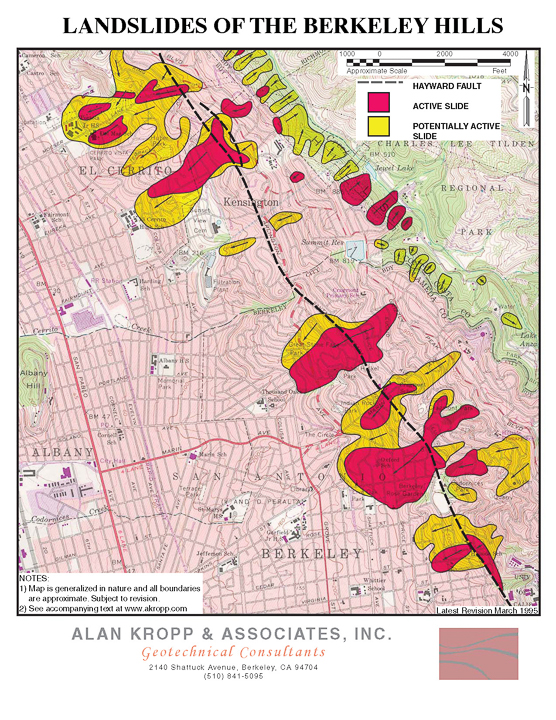

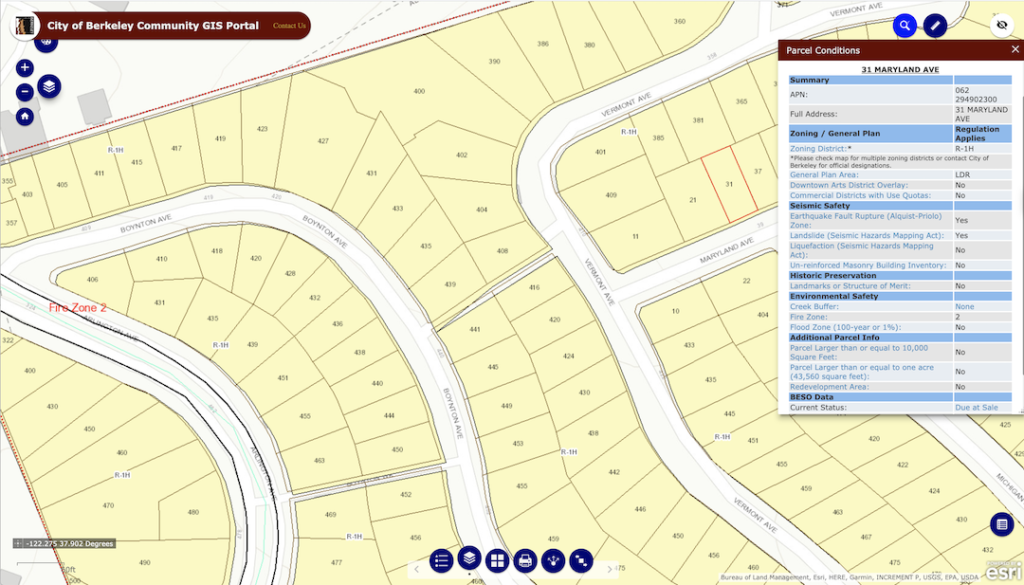

Learn About Our Fault And Slide Zones

Some buyers consider homes in these zones, others won’t.

Alan Kropp and Associates created the Berkeley Hills Landslide Map showing Berkeley’s earthquake and slide zones.

Berkeley’s Parcel Conditions and Permit History web page lets you easily find a home’s zones.

Involve Your Advisors

Decide if you like to consult with your friends, family members, or financial advisors. We’ll keep them updated if you wish.

Your attorney will advise of different ways to take title. If you want to own your home in a living trust, start the process early so the trust is in place in time for closing.

Update Your Online Connections

Relocating From another state or country?

Set up a free Zoom or Skype account so we can do video calls with you. Our Skype handle is “serkes” and we’re on WhatsApp at at 510-684-3334

Be Prepared!

The Boy Scouts had it right – Be Prepared … it’s the best way to start your home search.

#Serkes #Berkeley #WeLoveBerkeley #Home #Buyer